Ancoria Bank is hosted on the March issue of the economic magazine ‘Insider’ in a special feature concerning ‘Digital Banking and Payments’. In the article a detailed account of the award-winning applications and services offered by the bank is presented as well as how its customers can benefit from the use of technology.

Through continuous investment in technology, we have developed an array of award-winning services catering to the modern lifestyle, aiming to provide high-quality customer service. Since our inception in 2016, we have been offering customers a pioneering digital banking experience, blending physical and digital assistance, allowing them to choose their preferred mode of service. Technology has always been integral to our philosophy, prioritizing customer security and convenience. Amid the pandemic and unprecedented challenges, we were prepared to assist our customers with financial issues, having already invested in technology. The acceleration of processes and automation has reduced our expenses, enabling customers to benefit from competitive terms and charges, as well as improved service.

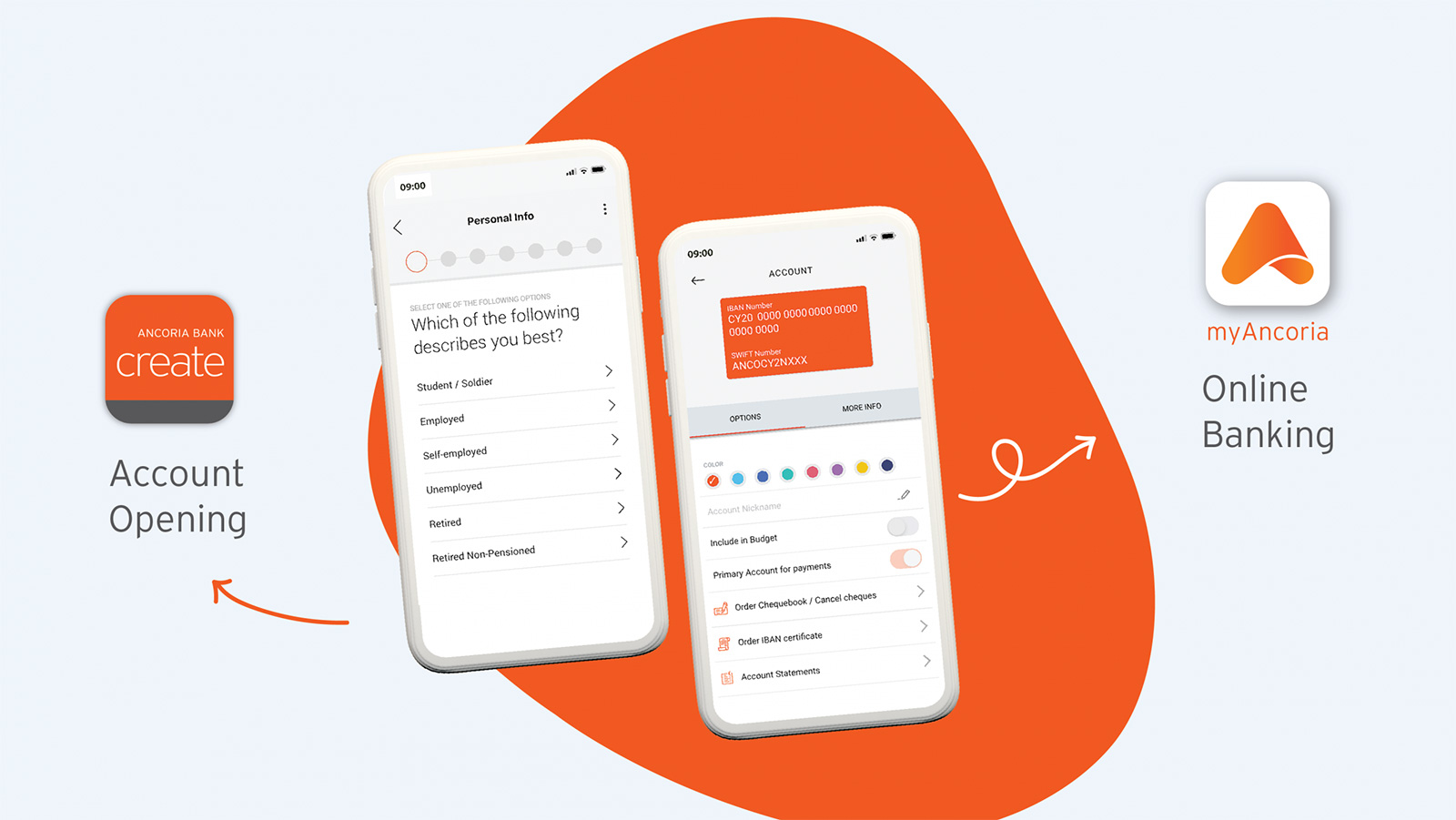

Moreover, we offer digital solutions for both individuals and businesses, aiming to provide easy, fast, and secure financial management for every customer. We introduced our flagship service, Ancoria Bank Create, in 2017, allowing individuals to open bank accounts via the award-winning mobile application without visiting a banking centre.

In addition, the myAncoria web/mobile banking platform offers all necessary banking functions in a user-friendly interface, including money transfers via mobile contacts and the popular Budgeting service for personal financial management. Biometric authentication ensures secure access to the app, while also approving various transactions.

Concerning loans our customers can use our user-friendly Loan Calculator to estimate loan repayments and eligibility, and instantly book appointments with bank representatives if they meet the criteria.

Another innovation is the virtual meetings with banking representatives via video calls, ensuring quality and personalized service while saving customers time from visiting a branch.

By leveraging technology effectively, we have redefined banking practices, prioritizing fast and friendly customer service, thereby gaining customer trust and building solid foundations for long-term relationships.

You can read the whole article here.