A new version of myAncoria (4.2.26) is available in the app stores and the web.

Upgrade turnover

There is a new functionality in myAncoria and it’s something you have been waiting for. You can now increase your account turnover up to €100k (that’s €100.000 for boomers)! That’s right! No joke! All you have to do is submit the necessary supporting documents through myAncoria and wait for the Bank’s approval.

Note that this applies only to digitally on-boarded customers and the yearly turnover may be extended at the Bank’s discretion upon the submission of satisfactory documentation.

“Do you understand the words that are coming out of my mouth?”

You want to open your first account with us. Right? You have downloaded the myAncoria app and you are in the process of digital onboarding. The language of the app is in English, but you can understand some terms better in Greek.

No worries! You can now change the language from English to Greek or Greek to English, in the app, while onboarding with only two (yes, we have counted them) moves.

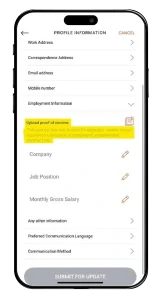

Bring your profile up to date

We have streamlined the process of updating your profile information and made it easier for you. Especially when it comes to uploading your proof of income. Now you can upload through the app the last 3 month’s payslips, recent social insurance contribution statement, employment contract etc.

myAncoria is constantly evolving. Stay tuned for more features that will help you manage your money with ease.

A new version of myAncoria (4.0.12) is available in the app stores and the web.

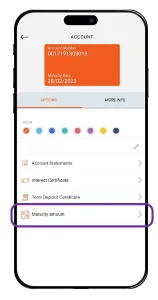

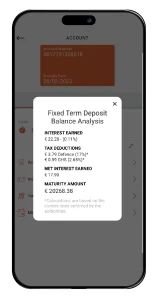

Show me the money… literally

You asked, we delivered! Now you can see the maturity amount of your Fixed Term Deposit Account, including the tax deductions and the interest earned. So, on maturity, you will know exactly how much money you will earn.

24

Give a warm welcome to our new product. The 24-month Fixed Term Deposit Account is now available on myAncoria. Get your 24-month Fixed Term Deposit without coming to the bank and make the most of our competitive interest rates.

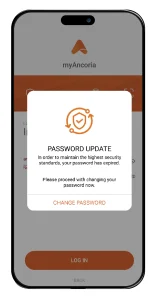

Password protected

We said it once, we said it twice, we said it a million times and we will keep saying it: SECURITY MATTERS! Keeping your account secure while using myAncoria is our top priority. That’s why we have updated our password policy and strengthened our password requirements for our online banking.

Your new password should consist of:

- 12-50characters *

- At least 1 number

- at least 2 UppeR case letters

- AT LEAST 2 LOWER CasE LETTERS

- At le@st 1 symbol and specia! character

- No Grεεκ letters

*(15 characters)

myAncoria is constantly evolving. Stay tuned for more features that will help you manage your money with ease.

A new version of myAncoria (3.16.28) is available in the app stores and the web.

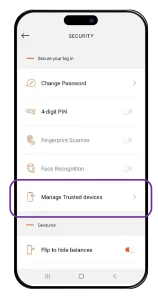

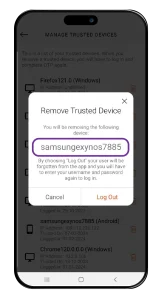

In these devices we trust

Through the “Security” tab on web and the myAncoria app, you can now see all your trusted devices in which you have previously logged in through. You can edit this list and remove the devices that you are not using anymore. However, have in mind that the mobile device can only be forgotten from the same mobile device you used to login. Additionally only one mobile device can be trusted at any given time.

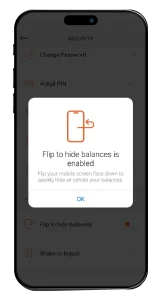

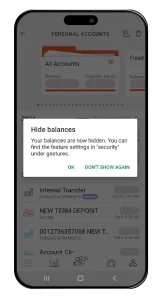

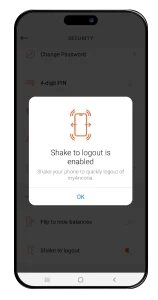

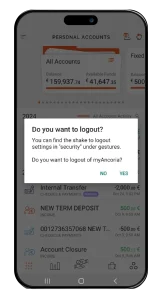

Shake, flip and stick the landing

We now have gestures in the myAncoria app. There is a new section in the “Security” tab, called “Gestures” which allows you to:

• Shake your phone and log out of the app.

• Flip your phone to hide your balances. Flip once more and they will appear again. Magic.

The Gestures feature is only available in the mobile app.

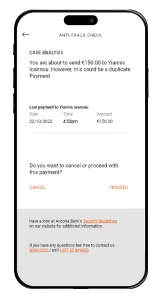

En garde

Besides the fact that we know some basic French, we take your security very seriously, so we have enhanced our myAncoria app with a new security feature in order to avoid duplicate payments. Namely, if you make a payment of the same amount to the same beneficiary on the same day, you will receive a notification if you wish to proceed with the payment just in case you had a trigger finger.

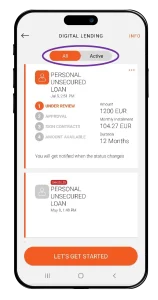

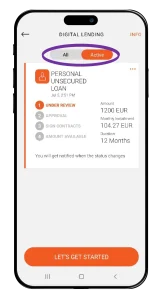

#withfilter

Everybody likes to be organised. You can now select what applications to see in your Digital Loan (myLo@n and myOverdr@ft) applications by choosing to see only the active ones. If you like organized chaos, the list with all applications is still visible!

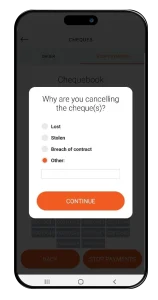

Scrap them cheques

Now you can cancel multiple cheques at once, and also add the reason why you cancelled each cheque for your records.

myAncoria is constantly evolving. Stay tuned for more features that will help you manage your money with ease.