Online banking is transforming the way individuals and businesses in Cyprus handle their finances. With secure, 24/7 access to accounts and services, users can transfer money, pay bills and manage their finances from the comfort of their home or on the go. This digital convenience saves time, cuts down on trips to physical branches and reduces banking costs.

For businesses, online banking streamlines payroll, tax and vendor payments, while offering real-time insights into cash flow, helping companies stay agile and efficient. Individuals benefit from easy bill payments, fast transfers and greater financial independence in their daily lives.

As Cyprus continues to embrace digital banking, both individuals and businesses are discovering new ways to make banking simpler, faster and more secure.

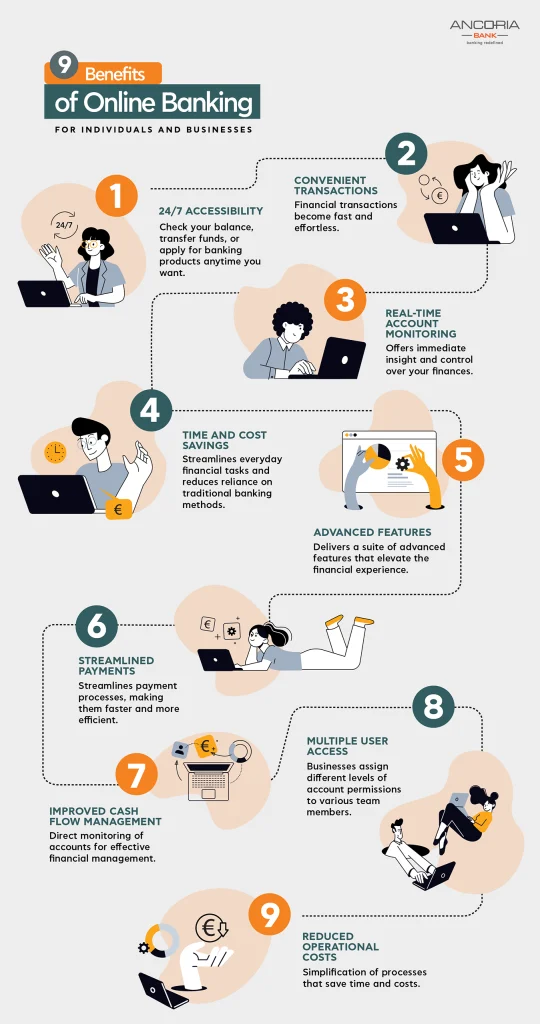

1. 24/7 Accessibility

One of the most significant advantages of online banking is its round-the-clock availability. As long as you have an internet connection, you can check your balance, transfer funds, or apply for financial products at anytime, anywhere. This flexibility far surpasses traditional banking hours. For individuals in Cyprus, this means you can easily monitor their finances without having to adjust their schedule to fit Banking Centre hours.

For businesses, especially those handling frequent local or international transactions, 24/7 access eliminates delays and helps keep operations running smoothly. This level of convenience can significantly boost productivity and efficiency.

With online banking, you can manage your accounts from anywhere, whether you’re at home, in the office, or travelling abroad. Using your computer, you stay connected to your finances, making personal money management and business operations easier than ever.

2. Convenient Transactions

Online banking makes financial transactions fast and effortless. With just a few clicks on your computer, you can transfer money, pay bills and set up automatic payments eliminating the need for paperwork and long waits at the bank. This convenience is especially valuable for individuals and businesses in Cyprus, allowing them to manage their finances at their own pace. For businesses, online banking streamlines operations by enabling secure, instant payments to vendors and employees, which helps them meet deadlines and maintain a smooth cash flow.

Accessing these services through user-friendly interface on personal computer and laptop means you can handle all your banking needs from anywhere. This flexibility not only saves time but also empowers both busy households and business owners to keep their finances organised and up to date.

3. Real-Time Account Monitoring

Real-time account monitoring is a core benefit of online banking, offering immediate insight and control over your finances for both individuals and businesses.

- Instant Access to Information: View account balances, recent transactions and pending payments at any time, from anywhere. This helps users keep track of their finances without waiting for monthly statements or visiting a branch.

- Enhanced Security: Immediate visibility into account activity makes it easier to detect unauthorised transactions or suspicious activity, allowing for quick response and greater peace of mind.

- Better Money Management: Individuals can monitor spending habits, avoid overdrafts and stay on top of bill payments. Businesses benefit from real-time oversight of their cash flow, enabling smarter and faster financial decisions.

Real-time account monitoring provides users with transparency, security and confidence in managing their finances, making it an essential feature of modern online banking.

4. Time and Cost Savings

Online banking offers substantial time and cost savings for both individuals and businesses by streamlining everyday financial tasks and reducing reliance on traditional banking methods.

- Fewer Banking Centre Visits: Most banking activities, like transfers, bill payments and account management, can be completed online, eliminating the need to visit a physical Banking Centre and wait in line.

- Faster Transactions: Digital banking enables instant money transfers, quick bill payments and immediate access to account information, saving valuable time compared to in-person processes.

- Lower Fees: Many online banking services come with reduced or no fees for transactions, account maintenance and statements, helping users save money.

- Automated Processes: Features such as scheduled payments and automatic transfers reduce manual effort, minimise late fees and ensure bills are paid on time.

- Reduced Administrative Work: For businesses, online banking automates payroll, vendor payments and more, decreasing paperwork and administrative costs.

- Paperless Banking: Electronic statements and digital record-keeping reduce printing, mailing and storage expenses.

By leveraging these efficiencies, online banking enables users to manage their finances more conveniently and cost-effectively, thereby freeing up time and resources for other priorities.

5. Advanced Features

Online banking delivers a suite of advanced features that elevate the financial experience for both individuals and businesses. Through online banking services users can streamline money management and boost productivity:

- Advanced Analytics: Visualise spending habits with detailed charts and reports, making it easier to budget and plan for the future.

- Scheduled Payments: Set up automatic transfers and bill payments to ensure obligations are met on time, reducing the risk of missed deadlines.

For businesses, digital banking simplifies complex tasks such as payroll processing and tax filing. Individuals also benefit from these innovations, with easy tools to track expenses, monitor investments and manage savings. These advanced features save time, foster smarter financial choices and empower users to achieve better money management and investment outcomes.

6. Streamlined Payments

Online banking streamlines payment processes, making them faster and more efficient for both individuals and businesses. With just a few clicks, users can securely complete one-time or recurring payments, eliminating the delays and paperwork associated with traditional banking.

For Βusinesses, streamlined payments enable:

- Faster settlements with vendors and suppliers

- Timely payroll processing for employees

- Improved cash flow management

- Reduced manual errors and administrative workload through automated payment options

For Ιndividuals, online banking offers:

- The ability to schedule bill payments and transfers instantly

- Fewer late fees thanks to automated reminders and payments

- Greater control and visibility over personal finances

This level of efficiency not only saves time but also improves financial accuracy and provides peace of mind, making payment management effortless and reliable for everyone.

7. Improved Cash Flow Management

Online banking delivers the benefit of improved cash flow management for both individuals and businesses. With instant access to account balances, transaction histories and payment schedules, users can monitor their finances in real time and make informed decisions.

For Businesses:

- Easily track incoming and outgoing payments to maintain healthy cash flow.

- Schedule supplier, payroll and tax payments to avoid late fees and ensure timely disbursements.

- Receive electronic payments quickly, accelerating receivables and improving liquidity.

For Individuals:

- Monitor spending and income instantly to prevent overdrafts and manage budgets more effectively.

- Use built-in budgeting and analytics tools to plan for future expenses and savings.

- Set up automated transfers to savings accounts, supporting long-term financial goals.

By streamlining these processes, online banking offers greater control, flexibility and stability, enabling individuals and businesses to maintain a healthy financial balance and respond quickly to changing financial needs.

8. Multiple User Access

Online banking provides the benefit of multiple user access, enabling businesses to assign different levels of account permissions to various team members. This feature boosts both security and operational efficiency by ensuring that only authorised individuals can perform specific banking functions.

For Businesses:

- Assign roles and permissions to employees based on their job responsibilities, such as viewing balances, initiating payments, or managing payroll.

- Strengthen internal controls by restricting access to sensitive financial data.

- Encourage collaboration across departments while maintaining accountability and security.

For Individuals:

- For Joint Accounts all the beneficiaries have access to that account and they can manage it more effectively.

9. Reduced Operational Costs

Online banking delivers the benefit of reduced operational costs for both businesses and individuals by streamlining financial processes and minimizing the need for traditional banking resources.

For Businesses:

- Lower Transaction Fees: Digital transactions often come with reduced fees compared to manual processing at Banking Centres.

- Less Paperwork: Electronic statements and digital record-keeping eliminate printing and mailing costs.

- Decreased Administrative Work: Automated payments and payroll reduce the need for manual labour, saving time and money.

- Fewer In-Person Visits: Managing finances online reduces travel expenses and frees up time for core business activities.

- Efficient Resource Allocation: By automating routine tasks, businesses can focus staff and resources on growth and innovation rather than administrative duties.

For Individuals:

- Savings on Transportation: No need to travel to a Banking Centre for most transactions.

- Reduced Service Charges: Many online banking services offer lower fees.

- Time Savings: Handling finances online frees up time for personal and professional pursuits.

What are the disadvantages of online banking?

Online banking offers many advantages, but it also comes with several disadvantages that users should consider:

- Security Risks and Cyber Threats: Despite strong security measures, online banking is vulnerable to cyberattacks, phishing scams and fraud. Users who do not follow recommended security practices, such as setting strong passwords or avoiding public Wi-Fi, are at increased risk of unauthorised access and financial loss.

- Technical Issues and Downtime: Access to online banking depends on a reliable internet connection and the bank’s systems being operational. Outages, maintenance, or software glitches can temporarily prevent users from accessing their accounts or completing transactions, which can be especially problematic in urgent situations.

- Learning Curve and Accessibility Issues: Some users, especially older adults or those less comfortable with technology, may find online banking platforms difficult to navigate. Language barriers and a lack of digital literacy can also make it challenging for some customers to use these services effectively.

- Potential Hidden Fees: While online banking often reduces costs, some services may come with hidden transaction fees, currency conversion charges, or limits on free ATM use that can add up over time.

- Limited Services: Certain specialised banking services available at traditional Banking Centres, such as foreign currency exchange, notarization, or tailored financial advice, may not be offered by online banks.

While online banking is generally safe and convenient, it is essential to be aware of its potential drawbacks and take appropriate precautions to protect your accounts and ensure you have access to all the necessary services.

How do online banking benefits compare to traditional banking?

Online banking and traditional banking in a Banking Centre each offer distinct advantages, catering to different needs and preferences in the financial landscape.

Online Banking: Key Advantages

- 24/7 Access and Convenience:

Manage accounts, transfer funds and pay bills anytime, anywhere, no need to visit a Banking Centre or wait for business hours. - Lower Fees and Better Rates:

Online banks often provide lower fees. - Faster Transactions:

Enjoy immediate transfers, real-time account monitoring and automated bill payments for streamlined money management. - Advanced Digital Tools:

Benefit from robust mobile apps and online platforms offering budgeting tools, spending analysis, instant alerts and easy account management. - Enhanced Security:

Features like multi-factor authentication, encryption and real-time fraud monitoring help protect your accounts, with many users valuing biometric logins and instant alerts.

Traditional Banking: Key Advantages

- Personalised Service:

Face-to-face interaction allows for tailored advice, relationship-building and direct support, which many customers still value for complex or sensitive matters. - Support for Complex Transactions:

In-person assistance is invaluable for mortgages, business loans, notarizations and other specialised services that may be difficult to manage online. - Cash Handling:

Banking Centres make it easy to deposit or withdraw cash, especially for large or unusual transactions. - Immediate Issue Resolution:

Direct, in-person help can resolve urgent or complicated problems on the spot, providing reassurance and clarity when needed.

Online banking excels in convenience, speed, lower costs and digital features, making it ideal for everyday transactions and tech-savvy users. Traditional banking remains essential for those who value personal service, need help with complex transactions, or require cash handling. Many customers now use both, enjoying the flexibility and strengths of each approach.