Personal Banking

Children’s Savings Account

Saving for what truly matters just got easier:

Start early

Open your child’s savings account as early as you like. The sooner you start, the more they’ll benefit, as their money grows along with them

Start low

You can open a savings account for your child with as little as €50 as your starting point

Earn interest

Your child will start earning interest from the very first Euro that is deposited in their monthly minimum balance

Total credit interest rate:

1.20%

Important information:

Parents or guardians can open an account on behalf of a minor who is under 18 years of age

Frequently Asked Questions

What is a Children’s Savings Account?

A Children’s Savings Account is a type of bank account specifically designed for minors under 18 years old. Parents or legal guardians can open a Children’s Savings Account on behalf of the child. The child will gain access to the savings once they turn 18 years old.

What is the purpose of a Children’s Savings Account?

A Children’s Savings Account is a great way to teach children about savings and financial literacy. It also allows parents to start building a solid financial future for their children, who will gain access to the money once they turn 18 years old.

How can I open a Children’s Savings Account?

Visit one of our Banking Centres in Nicosia, Limassol or Larnaca in order to open a Children’s Savings Account. Parents or guardians can open an account on behalf of a minor who is under 18 years of age and the sole beneficiary is the child.

What is the minimum initial deposit amount?

The minimum initial deposit on a Children’s Savings Account is €50.

Is there any interest rate on the Children’s Savings Account?

The total interest rate on a Children’s Savings Account is 1.20%. This interest rate is calculated on the monthly minimum balance of the account. You can find more information here.

Are there any fees on the Children’s Savings Account?

For information concerning the fees on Children’s Savings Accounts please click here.

Can I add a beneficiary to the Children’s Savings Account?

No, you can’t add a beneficiary to a Children’s Savings Account. The sole beneficiary is the child.

Can I withdraw money from the Children’s Savings Account?

No, you can’t withdraw money from the Children’s Savings Account, as it is in the name of the child. The child will be able to access the money once they turn 18 years old.

In case of an emergency withdrawal before the child reaches 18 years old, please contact us.

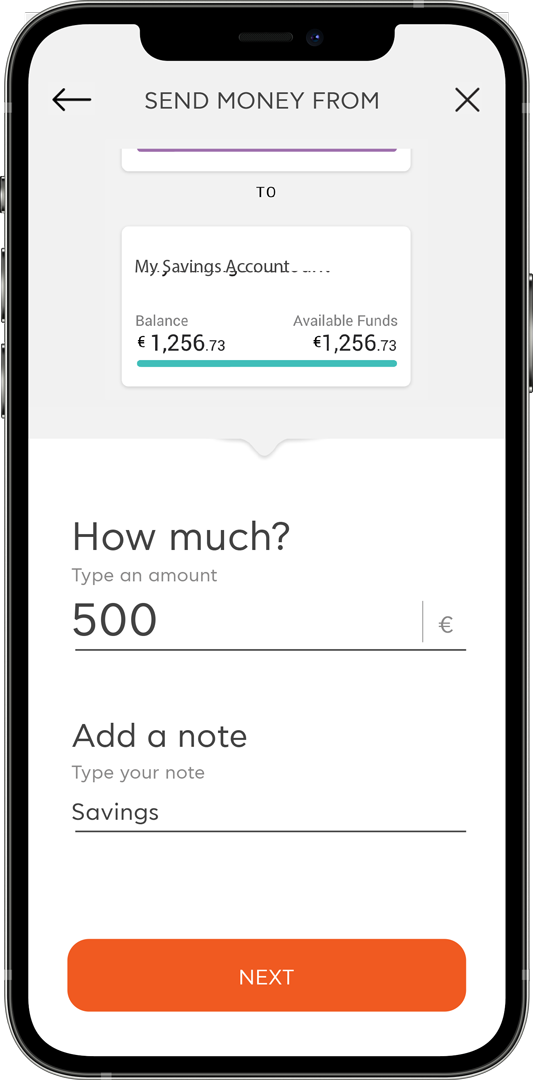

How can I deposit money to the Children’s Savings Account?

You can deposit money by transferring the amount from your Current Account to the Children’s Savings account through myAncoria on your personal computer, via the mobile app, or by visiting one of our Banking Centres in Nicosia, Limassol or Larnaca. You can also transfer money from any Banking Institution to the Children’s Savings Account by using the account’s IBAN.

How can I get information about the Children’s Savings Account transactions?

You have access to the Children’s Savings Account, through myAncoria, either on your personal computer or via the mobile app, providing that you are one of the parents or guardians.

What happens to the Children’s Savings Account when the child turns 18 years old?

When the child reaches 18 years old, the Children’s Savings Account turns into a General Savings Account, however it requires opening a Current Account in the beneficiary’s name (child).

Is the Children’s Savings Account protected by the Deposit Guarantee Scheme?

Deposits at Ancoria Bank are protected by the Deposit Guarantee and Resolution of Credit and Other Institutions Scheme. More information here.

Disclaimer: Ancoria Bank Ltd may at its choice, reject an application/business relationship for legal, regulatory or other reasons and withdraw or amend any plan, at any time.

Do you want to open an account?

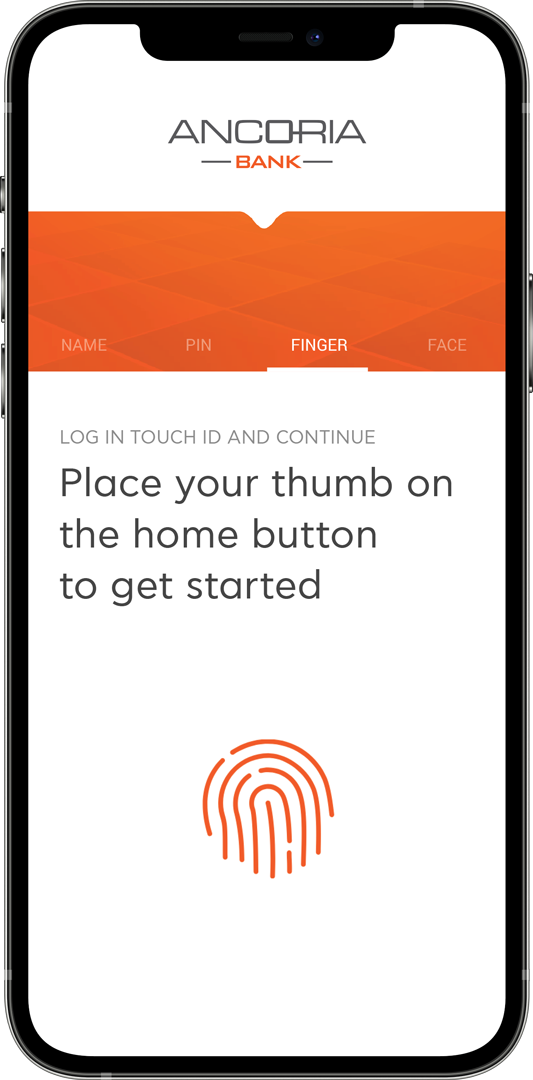

Get started by opening a Current Account simply and securely with the award-winning myAncoria app.

Our easy sign-up process will have you up and running within minutes. All you need to do is:

- Download the app

- Have all your documents on hand

- Take a quick selfie video

And your application will be all set! Once you join Ancoria Bank, you’ll be able to choose the account that best suits you.

If you have any questions, or simply need some help to get started

Call us on 8000 0050 or +357 22849000