Personal Banking

Fixed Term Deposit Account

Here’s how it works:

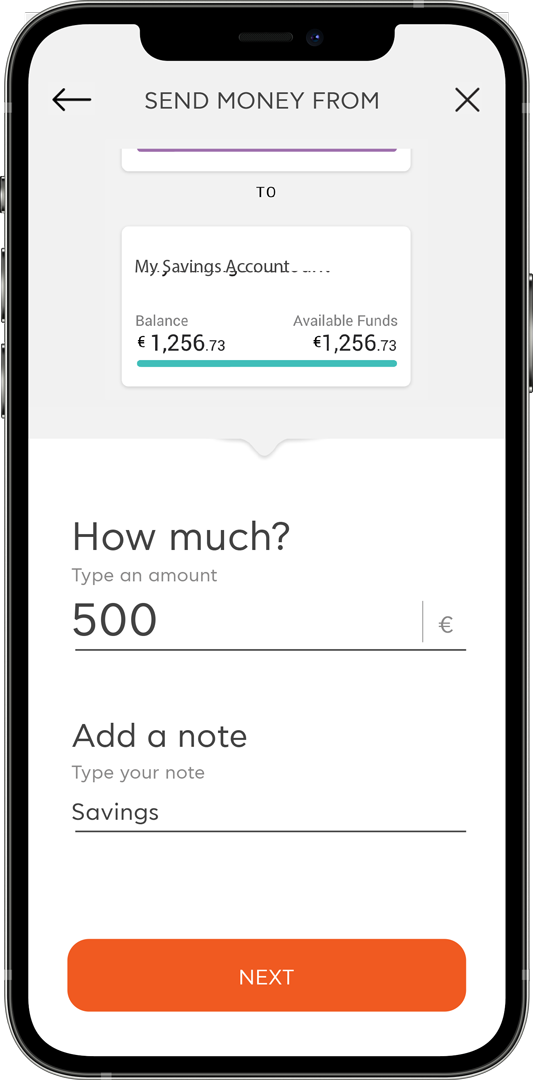

Open a Fixed Term Deposit Account with a minimum of €500

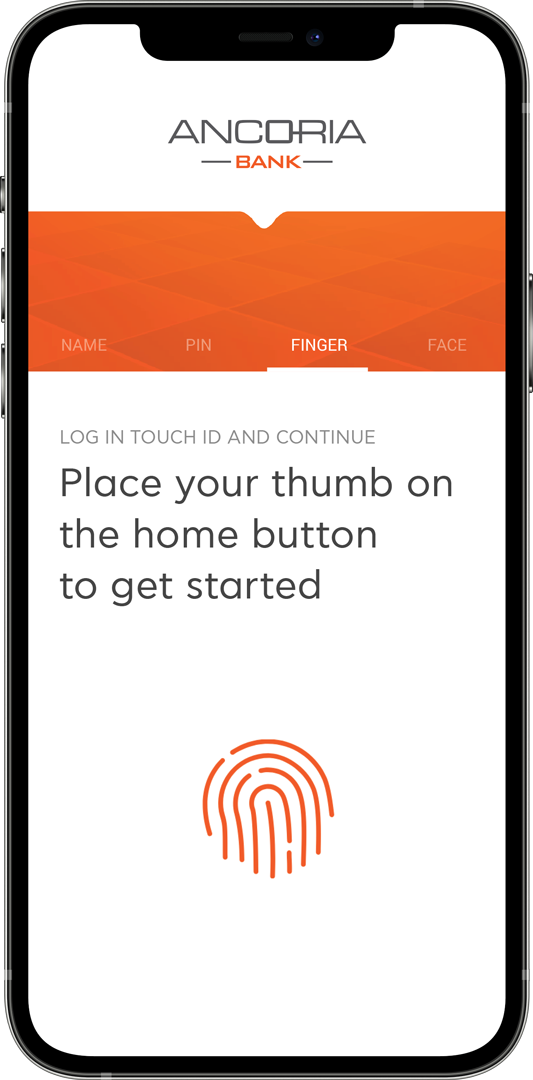

Open a Personal Fixed Term Deposit Account through myAncoria for a full digital experience. You will find more information here

The return you receive depends on the term of the deposit, so choose the term that best suits you

Interest is paid at the end of your chosen period

At maturity, you will have the choice of renewing the deposit with a new interest rate, or transferring your money to your current account for instant access

*Premature withdrawals will be charged a fee

Deposits at Ancoria Bank are protected by the Deposit Guarantee and Resolution of Credit and Other Institutions Scheme. More information here.

Choose the Fixed Term Deposit interest rate that suits you:

The rates are applicable to customers holding Fixed Term Deposits of up to €500,000. If the total Fixed Term Deposits (per customer) exceed €500,000, you can contact us directly for a quotation.

3 Months Term Deposit

0.50%

6 Months Term Deposit

1.30%

9 Months Term Deposit

1.25%

12 Months Term Deposit

1.20%

18 Months Term Deposit

0.85%

24 Months Term Deposit

0.75%

Frequently Asked Questions

What is a Fixed Term Deposit Account?

A Fixed Term Deposit Account is a type of savings account with a specific fixed interest rate for an agreed period of time. During the agreed period you can’t deposit or withdraw money from this account. In case you want to withdraw money before the maturity of the account, fees will be charged.

For which purposes can I open a Fixed Term Deposit Account with Ancoria Bank?

An Ancoria Bank Fixed Term Deposit Account is a great way to save for the long-term.

How can I open a Fixed Term Deposit Account with Ancoria Bank?

You can open a Fixed Term Deposit Account through the myAncoria app for a full digital experience. You will find more information here. Alternatively you can visit one of our Banking Centres in Nicosia, Larnaca and Limassol.

What is the minimum and the maximum amount for opening an Ancoria Bank’s Fixed Term Deposit Account?

You can open a Fixed Term Deposit Account with a minimum of €500 and maximum of €500,000. If the total Fixed Term Deposits (per customer) exceed €500,000, you can contact us directly for a quotation concerning the interest rates.

Do I have a right of withdrawal concerning my Fixed Term Deposit Account?

If you open your Fixed Term Deposit Account through myAncoria, you are entitled to withdraw from the distance agreement with the Bank within 14 calendar days, without any penalty and without providing any reason.

Are my deposits protected?

Deposits at Ancoria Bank are protected by the Deposit Guarantee and Resolution of Credit and Other Institutions Scheme (DGS).

What is the Deposit Guarantee Protection Scheme?

The Deposit Guarantee and Resolution of Credit and Other Institutions Scheme (DGS) guaranties that if insolvency should occur to the bank, your deposits would be repaid up to €100,000 (per depositor, per credit institution). You can find more information about DGS here.

Are there any tax deductions on a Fixed Term Deposit Account?

Customers who are tax residents of the Republic of Cyprus, on the capitalization of interest, the amount of the special Defence Contribution applicable and the General Health System contribution is deducted from accrued interest.

When can I withdraw money?

You can withdraw money at the maturity date of your Fixed Term Deposit Account.

Can I prematurely withdraw my money?

Yes, but premature withdrawals will be charged a fee. For more information please see our Table of Commission and Charges.

What options do I have at maturity?

At maturity, you will have the choice of renewing the Fixed Term Deposit with the new interest rate that is applicable by the Bank, or transferring your money to your current account for instant access.

What is the procedure for renewing a Fixed Term Deposit Account?

You can choose for your Fixed Term Deposit Account to be renewed automatically upon maturity or contact the Bank to give instructions before your account expires.

How is the interest calculated?

The credit interest is calculated on the credit balance of the Account on a daily basis and is capitalized on the maturity date of the Fixed Term Deposit period. For Customers who are tax residents of the Republic of Cyprus, on the capitalization of interest, the amount of the special Defence Contribution applicable and the General Health System contribution is deducted from accrued interest.

When is the interest paid?

The interest you earn is paid at the end of the chosen period.

How can I find out the amount I will collect at maturity?

You can see the amount you will collect at maturity through the myAncoria application, by selecting your Fixed Term Deposit Account and choosing ‘Maturity amount’ in the ‘Options’ tab.

What are my options on collecting interest?

At maturity you have the option to transfer any interest received to your account and renew the Fixed Term Deposit only for the original amount.

Can I add a beneficiary to my existing Fixed Term Deposit Account before maturity?

No, but if you add a beneficiary at the maturity of your Fixed Term Deposit Account. In this case, you will have to sign a new contract with the Bank.

How many beneficiaries can be on a Fixed Term Deposit Account?

There is no specific limit in the beneficiaries of a Fixed Term Deposit Account.

What is better, a Fixed Term Deposit Account or a Savings Account?

Depending on your needs and your financial goals, you can choose witch type of account suits you best.

Disclamer: Ancoria Bank Ltd may at its choice, reject an application/business relationship for legal, regulatory or other reasons and withdraw or amend any plan, at any time.

Do you want to open an account?

Get started by opening a Current Account simply and securely with the award-winning myAncoria app.

Our easy sign-up process will have you up and running within minutes. All you need to do is:

- Download the app

- Have all your documents on hand

- Take a quick selfie video

And your application will be all set! Once you join Ancoria Bank, you’ll be able to choose the account that best suits you.

If you have any questions, or simply need some help to get started

Call us on 8000 0050 or +357 22849000