Personal Banking

Current account

The best our Current Accounts have to offer:

Easily manage your banking needs

You can use any ATM in Cyprus up to ten times per month, free of charge, to access your cash. Set up standing orders and direct debits, and receive SMS notifications for debit card*** transactions and transfers

Deposit your salary and benefit

By depositing your salary directly into your current account, you can benefit from a lower debit interest rate on your overdraft of 8.75% APR 18.25%

Choose what’s best for you:

Opt in for an overdraft

The overdraft limit amount permitted will be according to your monthly income. You will be charged at the debit interest rate according to daily balances on a 365/366 days basis*

Option of different currencies

Open your current account in one of the following currencies: Euro (EUR), British Pounds (GBP), US Dollar (USD), Swedish Krona (SEK), Japanese Yen (JPY), Swiss Franc (CHF), Polish Zloty (PLN)

Representative example:

At Ancoria Bank, we want to make sure that you have all the information you need at all times. We’ve provided a representative example, that you can use as a guide.

Overdraft limit

€5,000

Debit interest rate

8.75%

Interest rates vary according to the usage of the account

APR**

18.25%

IMPORTANT INFORMATION

*An overdraft limit of up to two monthly salaries with a maximum amount €10,000. The overdraft limit amount permitted will be according to your monthly income. You will be charged at the debit interest rate according to daily balances on a 365/366 days basis*

- Overdraft Interest rate consists of the base + the margin. Interest Rate margin is the same for all currencies but the base varies based on the currency of the account as follows: i) BBRC for EUR, ii) BOE Bank rate for GBP, iii) NBP Reference Rate for PLN, iv) Riksbank Repo Rate for SEK, v) BOJ Basic Loan rate for JPY and vi) SNB Mid Target rate for CHF. For the definitions of the base rates used click here.

- Capitalisation of Debit Interest will be done twice a year (on 30th June and on 31st December).

NOTES

**APR (Annual Percentage Rate) has been calculated on 14/04/2025 based on the following:

- Interest Rate: Bank’s Base Rate Consumer (BBRC) today at 3.05% + margin 5.70%

- Initial charges: Processing fees of 1% charged on total amount of overdraft and documentation fees of €50

- Overdraft limit: €5,000

- Term: 3 months (revolving)

- The APR will vary in the event that any of the above variables change

The above pricing refers only to Resident Customers. If you are Non Resident in Cyprus please click here.

Frequently Asked Questions

What is a Current Account?

A Current Account is your everyday bank account where money is easily transferred in and out. You can quickly receive payments, make purchases, pay bills, and withdraw cash. Moreover, it gives you many features to make your financial life more manageable, like a bank card for quick payments and access to online and mobile banking to manage your account efficiently.

How can I open a Current Account at Ancoria Bank?

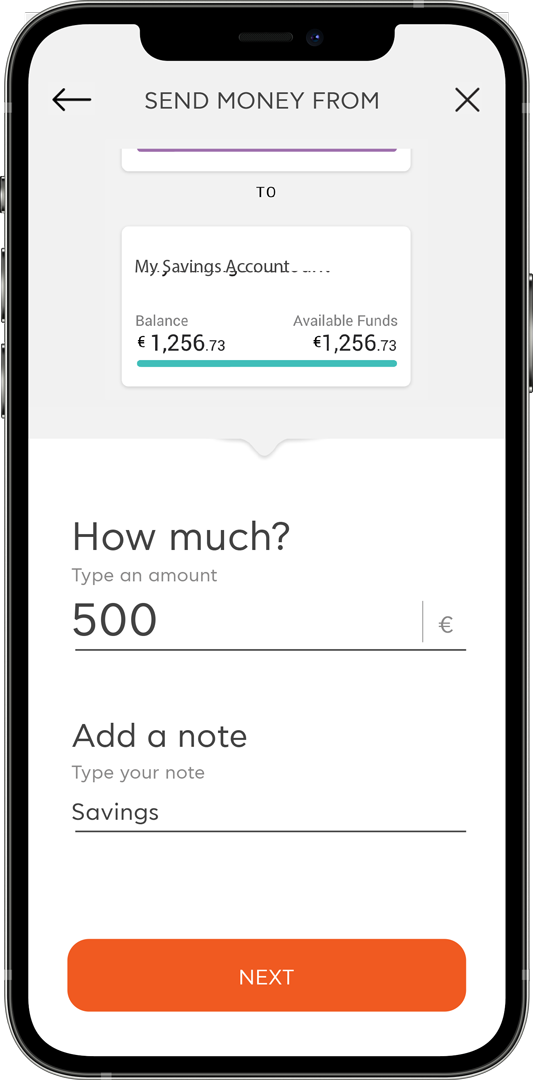

You can visit one of our Banking Centres in Nicosia, Limassol and Larnaca, or download the myAncoria app and open the account digitally.

What documents do I need to open a Current Account?

You’ll need a valid Cyprus ID card or passport and a recent utility bill with your address.

Can I request an overdraft on my Current Account?

Yes, you can request an overdraft on your Current Account. In order to do so, you have to visit one of our Banking Centres in Nicosia, Limassol or Larnaca.

How can I withdraw money from my account?

You can use your Debit Card at any ATM in Cyprus up to ten (10) times per month, free of charge, to access your cash.

Are there any fees for opening a Current Account at Ancoria Bank?

You can find more information about the fees of opening a Current Account at Ancoria Bank here.

Are there any maintenance fees on my Current Account?

You can find more information about the fees of opening a Current Account at Ancoria Bank here.

Can I add a beneficiary to my existing Current Account?

If you want to add a beneficiary to your existing Current Account, you may request to open a new joint account by visiting one of our Banking Centres in Nicosia, Limassol or Larnaca.

What is the Deposit Guarantee Scheme?

Deposits at Ancoria Bank are protected by the Deposit Guarantee and Resolution of Credit and Other Institutions Scheme. More information here.

***The Ancoria Bank Mastercard® Debit Card is issued by IPS Solutions Ltd pursuant an affiliate license by Mastercard International Incorporated. IPS Solutions Ltd is registered in Cyprus HE 346719 Registered Office: 62 Athalassas, Office 101, 2023, Strovolos, Nicosia, Cyprus. IPS Solutions Ltd is an authorised Electronic Money Institution, licensed, registered, and supervised by Central Bank of Cyprus with license number 115.1.3.28. Your Ancoria Bank Mastercard Debit Card is governed by the General Terms and Conditions of Ancoria Bank Ltd. Your debit card will access the available balance in your Ancoria Bank current account. Ancoria Bank Ltd is licensed, registered, and supervised by the Central Bank of Cyprus with license number 115.1.1.1.8.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Warning: If you fail to meet your loan repayment plan, you may lose your home/other property.

Warning: In case of variable interest rates, the instalment amount and total cost of the facility may increase or decrease depending on variations in the base rate.

Disclaimer: Ancoria Bank Ltd may at its choice, reject an application/business relationship for legal, regulatory or other reasons and withdraw or amend any plan, at any time. The granting of credit facilities is subject to the granting of security acceptable to the Bank. In certain cases, the offer which Ancoria Bank Ltd may make, may differ, following an assessment of your personal financial and other circumstances.

Do you want to open an account?

Get started by opening a Current Account simply and securely with the award-winning myAncoria app.

Our easy sign-up process will have you up and running within minutes. All you need to do is:

- Download the app

- Have all your documents on hand

- Take a quick selfie video

And your application will be all set! Once you join Ancoria Bank, you’ll be able to choose the account that best suits you.

If you have any questions, or simply need some help to get started

Call us on 8000 0050 or +357 22849000